We are a global asset manager with extensive expertise and access to a deep set of investment options drawing from both our internal equity and fixed income strategies as well as our open architecture platform. Our advisors create customized solutions that meet the specific needs of each of our clients. Our services include investment policy design, asset allocation and portfolio construction, security selection and ongoing portfolio management.

Investment Advisory Philosophy and Approach

A broad perspective and a deep investment capability allow us to rapidly adapt and change course when markets or client goals and objectives dictate that we do so.

Given the ever-changing economic and market conditions, we maintain an environment in which our advisors can focus on your long-term goals and objectives yet remain nimble in order to be proactive on your behalf.

- Advice-driven approach

- Comprehensive review of portfolio, investment goals and objectives

- Development of investment policy statement, strategic and tactical asset allocation recommendations

- Hybrid architecture; internally managed strategies and open architecture

- Manager due diligence, selection and monitoring

- Access to F.L.Putnam portfolio managers

- Continuous investment in technology and operational infrastructure

Our services include an array of internally managed equity and fixed income separate account strategies that can be customized to meet the specific goals and objectives of our clients. Our strategies have been designed to meet the varying goals and objectives of our clients – one size does not fit all.

Equity Philosophy and Approach

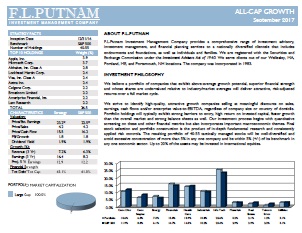

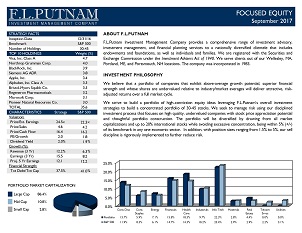

We believe a portfolio of companies that exhibit above-average growth potential, superior financial strength and whose shares are undervalued relative to industry/market averages will deliver attractive, risk-adjusted returns over a full market cycle.

Global Expertise

- Broadly diversified

- Actively managed across all market segments

- Captures diverse factor premiums (size, value, quality, momentum)

- Supports multiple strategies

Driven by Fundamental Research

- Collaborative investment team

- Bottom-up stock selection

- Informed by broad economic themes

- Integrated ESG research

Refined by Thoughtful Portfolio Construction and Risk Management Techniques

- Customized equity portfolios comprised of individual securities

- Long-term investors

- Active risk management

- Rigorous sell discipline

In addition to managing customized equity portfolios, we also manage a number of distinct strategies:

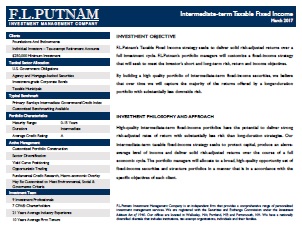

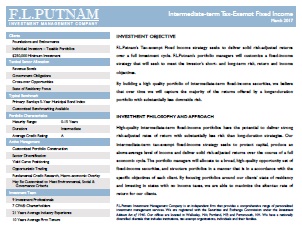

Fixed Income Philosophy and Approach

We believe actively managed, high-quality, short-to-intermediate term maturities will provide a transparent source of income and stability, which will lead to superior risk-adjusted returns over a full market cycle.

Active Risk Management

- High-Quality Securities

- Short-to-Intermediate Maturities

- Extensive Credit Research

Rigorous Cost Containment

- Low Turnover

- Institutional Purchasing Power

- Proprietary Trading Network

Strategies Include:

- Intermediate-term Taxable Fixed Income

- Customized Socially Responsible Fixed Income

Cash flow planning is a broad, multifaceted effort that involves the coordination of a number of non-financial factors. We start with a comprehensive analysis of cash flows, assets and future requirements to arrive at a plan built to meet your organization's unique goals and objectives.

Client-Centric

All plans begin and end with your input, collaboration, and participation. Your needs shape the planning process.

Goal-Based, Data-Driven

Combining our knowledge with the most powerful technology on the market, we quantify, prioritize, and evaluate how best to meet your financial goals and objective

Comprehensive Planning

Our fee-only service model enables our professionals to act in your best interests. Services include:

- Investment Policy Statement integration

- Cash flow planning

- Future funding

- Annual withdrawals

- Project funding

- Required returns

- Coordination with other advisors

Our hybrid platform includes both active and passive strategies as well as traditional and alternative investments. This diversity of investment options enables our advisors to tailor portfolios specifically to meet our clients’ goals and objectives.

- Highly customized offering – multiple solution sets

- Low-cost access to internally managed strategies

- Third-party strategies – fully vetted open-architecture platform

- Passive strategies to create specific asset class exposures

- Built to meet the needs of a diverse client set

- Advisors work directly with clients to establish investment objectives and build investment policy statements designed to meet specific goals and objectives

- Access to dedicated investment team, including portfolio managers and analysts

- Expertise in asset allocation, investment management and manager selection

- Integrated advice

We are a global asset manager with extensive expertise and access to a deep set of investment options drawing from both our internal equity and fixed income strategies as well as our open architecture platform. Our advisors create customized solutions that meet the specific needs of each of our clients. Our services include investment policy design, asset allocation and portfolio construction, security selection and ongoing portfolio management.

Investment Advisory Philosophy and Approach

A broad perspective and a deep investment capability allow us to rapidly adapt and change course when markets or client goals and objectives dictate that we do so.

Given the ever-changing economic and market conditions, we maintain an environment in which our advisors can focus on your long-term goals and objectives yet remain nimble in order to be proactive on your behalf.

- Advice-driven approach

- Comprehensive review of portfolio, investment goals and objectives

- Development of investment policy statement, strategic and tactical asset allocation recommendations

- Hybrid architecture; internally managed strategies and open architecture

- Manager due diligence, selection and monitoring

- Access to F.L.Putnam portfolio managers

- Continuous investment in technology and operational infrastructure

Our services include an array of internally managed equity and fixed income separate account strategies that can be customized to meet the specific goals and objectives of our clients. Our strategies have been designed to meet the varying goals and objectives of our clients – one size does not fit all.

Equity Philosophy and Approach

We believe a portfolio of companies that exhibit above-average growth potential, superior financial strength and whose shares are undervalued relative to industry/market averages will deliver attractive, risk-adjusted returns over a full market cycle.

Global Expertise

- Broadly diversified

- Actively managed across all market segments

- Captures diverse factor premiums (size, value, quality, momentum)

- Supports multiple strategies

Driven by Fundamental Research

- Collaborative investment team

- Bottom-up stock selection

- Informed by broad economic themes

- Integrated ESG research

Refined by Thoughtful Portfolio Construction and Risk Management Techniques

- Customized equity portfolios comprised of individual securities

- Long-term investors

- Active risk management

- Rigorous sell discipline

In addition to managing customized equity portfolios, we also manage a number of distinct strategies:

Fixed Income Philosophy and Approach

We believe actively managed, high-quality, short-to-intermediate term maturities will provide a transparent source of income and stability, which will lead to superior risk-adjusted returns over a full market cycle.

Active Risk Management

- High-Quality Securities

- Short-to-Intermediate Maturities

- Extensive Credit Research

Rigorous Cost Containment

- Low Turnover

- Institutional Purchasing Power

- Proprietary Trading Network

Strategies Include:

- Intermediate-term Taxable Fixed Income

- Intermediate-term Tax-Exempt Fixed Income

- Customized Socially Responsible Fixed Income

Our hybrid platform includes both active and passive strategies as well as traditional and alternative investments. This diversity of investment options enables our advisors to tailor portfolios specifically to meet our clients’ goals and objectives.

- Highly customized offering – multiple solution sets

- Low-cost access to internally managed strategies

- Third-party strategies – fully vetted open-architecture platform

- Passive strategies to create specific asset class exposures

- Built to meet the needs of a diverse client set

- Advisors work directly with clients to establish investment objectives and build investment policy statements designed to meet specific goals and objectives

- Access to dedicated investment team, including portfolio managers and analysts

- Expertise in asset allocation, investment management and manager selection

- Integrated advice

Sustainable Investing

Sustainable Investing

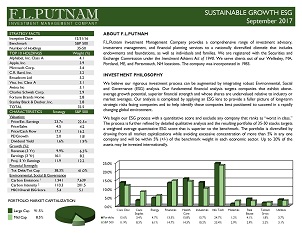

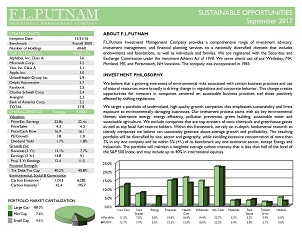

We have decades of experience in environmental, social and governance (ESG) analysis and socially responsible investing (SRI). We have leveraged our experience to build a broad solution set for clients who are interested in sustainable investing. We help clients balance three key objectives: to address social and environmental challenges, to align portfolios with core values or mission, and to achieve long-term financial objectives.

Our Research Process

Research, data and technology are the foundation of all we do. We use a combination of outside data providers and internal proprietary research to inform our investment approach and provide detailed reporting to clients. Our approach allows us to capture and analyze ESG data across global markets and dive deeply into select investment vehicles and individual companies. Our research effort provides insight into key themes that shape the sustainable investing movement. This information aids our ability to navigate a rapidly evolving landscape on behalf of our clients.

ESG Integration

Evaluating companies using a broad ESG framework can help investors better assess the long-term sustainability of business models in an increasingly global business environment marked by ever-changing regulations, resource constraints, supply chain risks and social & environmental impact awareness.

As fundamental investors, F.L.Putnam is always focused on the financial sustainability of the companies in which we invest client capital. Our approach to investing is based on thorough research of individual companies, industries and associated trends. We analyze the critical components of growth potential, financial strength and valuation. Our long history of in-depth fundamental research and experience with socially responsible investing makes ESG integration a natural extension of our process. ESG analysis provides a fuller picture of the long-term strategic risks facing companies and can help identify management teams who are proactively addressing these risks.

Our approach to incorporating ESG factors into our investment process involves a combination of in-house proprietary research performed by our analysts and portfolio managers, as well as the use of third-party data provided by independent research firms. The combination of in-depth research along with ESG scores ensures that we have a clear understanding of both qualitative and quantitative factors that will affect company strategy—and over time—investment performance.

We develop and refine sustainable investing policy statements that are guidelines for our investment approach.

We provide strategic and tactical asset allocation across asset classes using a mix of internally managed strategies as well as external strategies accessed through our open architecture platform.

Our research effort and depth of knowledge provide a foundation for ongoing client education, a service we believe is important given the diverse and complex options available to investors.

We provide comprehensive reporting, built to help clients understand how ESG and SRI factors shape our approach to research and portfolio construction, affect performance, and provide the ability to compare portfolios to broad benchmarks through carbon footprinting and other analytics.

We offer a range of proprietary public market solutions across equities and fixed income:

- ESG factor integration: We use our ESG research to tilt portfolios toward companies best equipped to navigate material ESG risks.

- Thematic investing: We target exposure to companies that are focused on sustainable products, services or business practices or those positioned to benefit from shifting regulations.

- Socially Responsible Investing: We align investments with our clients’ core values by excluding companies exposed to objectionable products, services or business practices.

- Green and sustainability bonds: We target investment in fixed income securities where proceeds support specific sustainable projects or investments, when appropriate.

We offer several targeted Sustainable Investing strategies as well as custom tailored portfolios to meet specific client objectives.

- Targeted strategies: We have built a suite of Sustainable strategies to meet the needs of our clients.

- Custom management: We craft portfolios that incorporate fundamental and ESG research with each client’s specific SRI guidelines.

We are constantly reviewing opportunities across a wide range of private investments to address specific social and environmental challenges while providing financial returns.

Examples range from low minimum investments in community loan funds to direct investments in private equity impact funds for qualified purchasers.

Traditional Community Loans

- Targets marginalized communities to deliver specific social benefits (e.g., housing, development, other goods/services at affordable rates)

- Investible products (often bank or private investment) with known risk and return

Microfinance

- Provides small loans to entrepreneurs (e.g., Grameen Bank and Muhammad Yunus, winners of 2006 Nobel Peace Prize) to reduce poverty by providing financial intermediation

- Investible products (often private investments) with known risk and return.

Social Impact Bonds

- A public sector contract to pay for improved social outcomes that result in public sector savings (private investments)

Direct Private Fund Investments

- Investments in venture capital, private equity, private debt, real asset and other funds or fund-of-funds targeting multiple underlying managers

- Underlying investments target areas such as: land conservation & management, sustainable agriculture, renewable energy development, early stage socially and environmentally focused technology company funding and development, and microfinance and banking for underserved populations

Financial Planning

Financial Planning

Financial planning is a broad and multifaceted effort that involves the integration of investments with other personal considerations. We begin with a comprehensive analysis of income and expenses, as well as assets and liabilities to arrive at a plan crafted to meet your unique goals and objectives.

Financial Planning Philosophy and Approach

We believe holistic and collaborative planning empowers clients to take control of their financial future. We leverage our experience and expertise to inform the ongoing decisions that shape your financial health in practical, understandable terms.

- Client-Centric All plans begin and end with your input, collaboration, and participation. Your needs shape the planning process.

- Goal-Based, Data-Driven Combining our knowledge with the most powerful technology on the market, we quantify, prioritize, and evaluate how best to meet your financial goals and objectives.

- Comprehensive Planning Our fee-only service model enables our professionals to act in your best interests.

Our Certified Financial Planners® provide unbiased advice in a professional, comfortable environment, and deliver professional, fee-only financial planning, investment management, and investment advisory services.

Comprehensive Financial Planning Services include:

Our financial planning clients also enjoy access to their own personal financial website with helpful tools such as:

- Powerful account aggregation

- Budget tracking

- Secure document storage

- Financial tutorials

There are no minimums to work with us on a financial planning project. From major life transitions to minor bumps along the way, we give you the advice you need to make informed decisions.

$500

Rollover Help? Employee Benefit selection?

Review of your investments?

We know that not every situation calls for a comprehensive evaluation.

Come in for a one-time consultation and get the guidance you need.

Start with a $250 Framework

and Onboarding Session

Continue our program

at $20-$100/month*

Subscribe to our planning platform and enjoy the best we have to offer. You'll get access to our budget tracking, account aggregation and financial reporting software from your own, secure personal financial website.

Over time we'll develop goals, monitor progress and resolve issues as they arise.

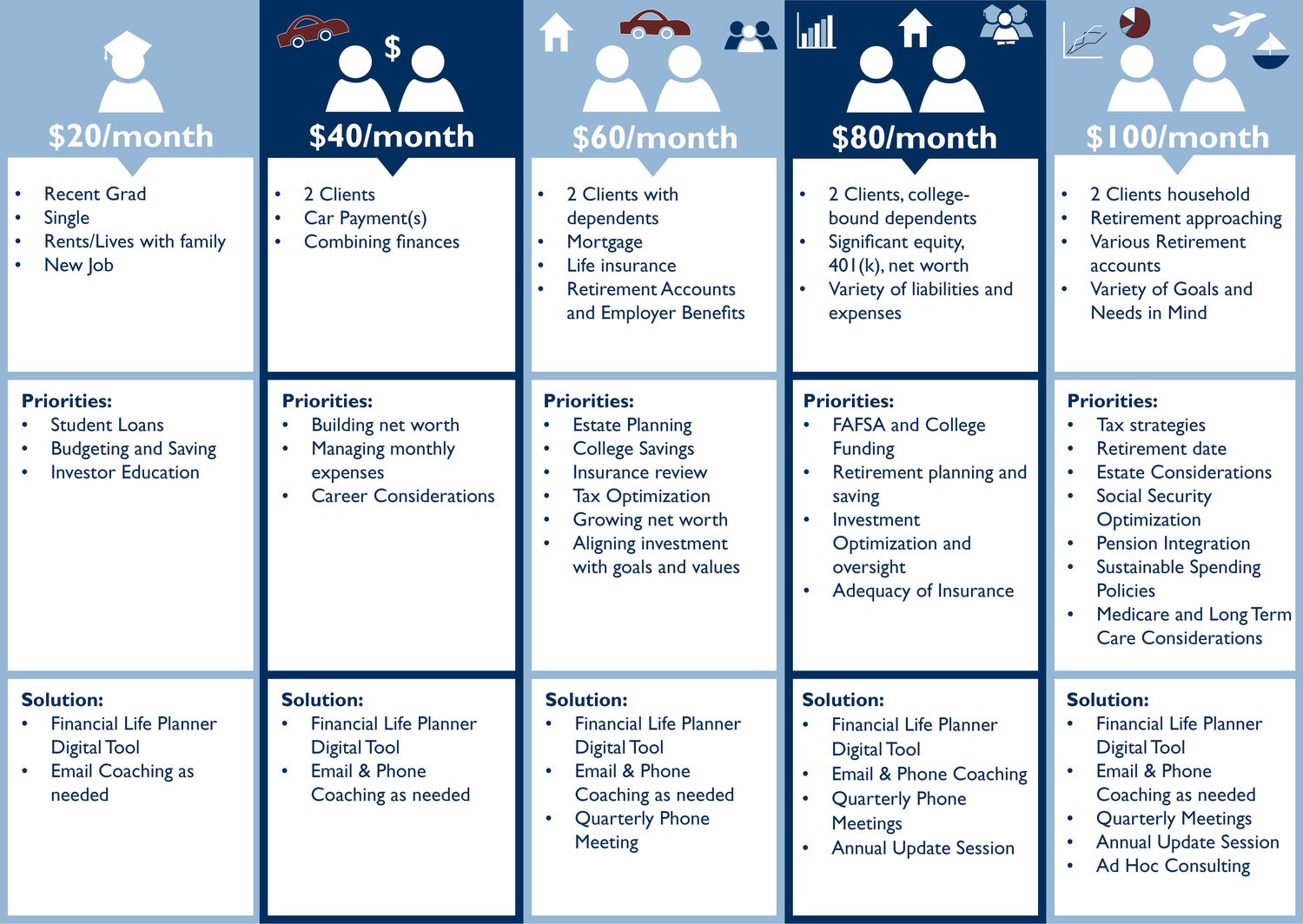

* Monthly cost varies by size of household, complexity, net worth, coaching needs, and income.

$3500 - $5000 Comprehensive

A complete financial picture begins with rigorous data gathering and is followed with deep analysis and advanced planning. The result is a comprehensive view with detailed guidance.

Cost of plan begins at $3500 and can vary depending on complexity.

Where will you land? Take a look at these examples to see where you may fall on our pricing grid. We'll ask you a series of questions about your household, income, assets, goals, and needs. From there, we'll determine the level of service that meets your needs, and set the appropriate monthly fee.

Click here to view or download a preview of your secure, personal financial website.